Paying for something in a store seems like a relatively simple affair. A card and a payment terminal connect for as long as needed to verify a customer has the funds. The payment is then approved or declined. Said customer usually walks away with the goods

That’s where a customer’s involvement ends. Unless there’s a dispute or refund issued. Merchant and acquiring services are the terms used to describe what goes on to ensure a transaction can be processed.

Before the 1960’s, ‘merchant services’ were a simple matter of a merchant – usually a retailer or other consumer-facing business – collecting payments on the day or agreeing to collect a payment later, thereby extending ‘credit’ to a customer. For this to happen, a merchant had to know something about a customer, such as their family background, employment status and have some kind of relationship with them. This had worked for centuries, but by the 1960’s it was a model starting to feel the strain under modern consumer needs and a faster pace of life.

Introducing ‘Card Associations’

Anticipating a need for more secure, faster payment processing, American banks formed two card associations, known as National Bankamericard and Mastercharge. Eventually, they became Visa and MasterCard, responsible for billions of transactions every year.

These associations performed an INTERCHANGE service, establishing the rules for authorisation, clearing, settlement, whilst setting rates that banks could charge for transactions. Associations soon gave merchants confidence that a customer carrying a card with that branding meant that there was less chance of fraud or a transaction not clearing.

‘Issuing’ and ‘Acquiring’ Banks

Our modern merchant services system is built on a simple premise.

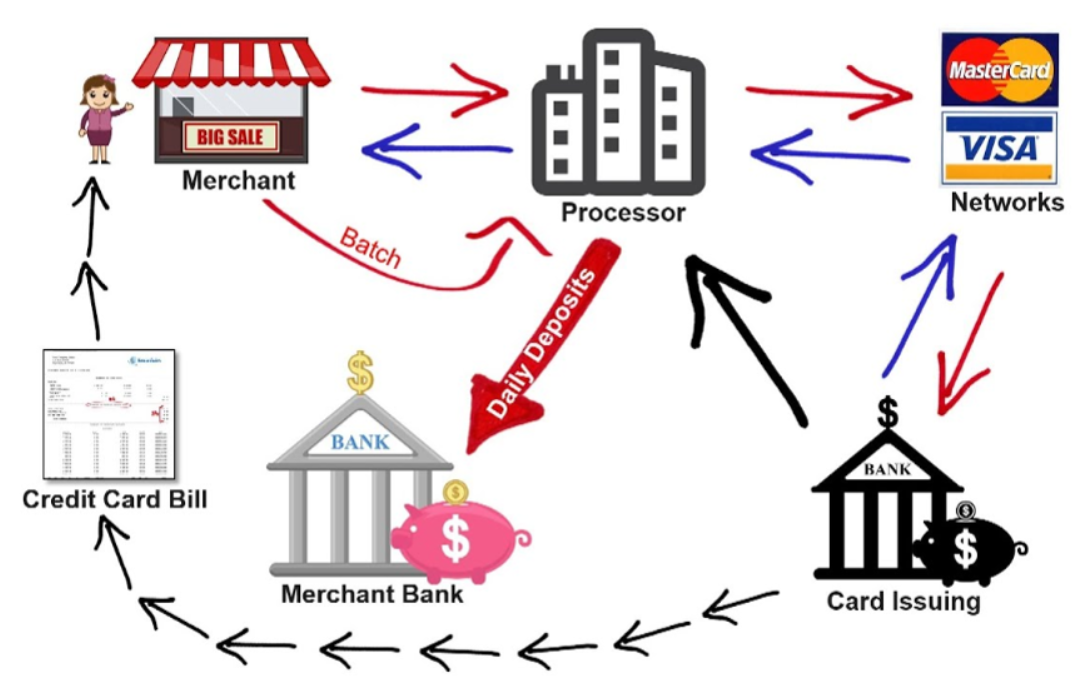

A customer wants to purchase something. A merchant also wants to make a sale and get the money for that item or service. The ‘Issuing’ bank acts on the customers behalf, whereas the ‘Acquiring’ bank acts for the merchant. In between them is the card association (Visa or MasterCard), acting as a ‘referee’ for the customer.

The referee doesn’t handle the funds, but it does ensure everyone is protected during the transaction. Once sufficient funds have been confirmed by the Issuing bank then a payment can go through. An Acquiring bank then acquires the funds for the merchant, putting the money into a ‘merchant account’ – which has to be separate to the merchants business account.

Naturally, the system has evolved since those early days in the 1960’s and 1970’s. Trial and error have shown what works, what doesn’t and how to make the process faster and more secure.

What’s Involved In An Average Transaction?

- Step #1: The customer buys goods or services from a merchant.

- Step #2: The purchasing information is sent to the Acquiring bank, either through an IP terminal, processing software or online payment gateway.

- Step #3: The transaction information is sent to a processor and onto the relevant card association.

- Step #4: The card association then sends this information to the Issuing bank, for authorisation.

- Step #5: The Issuing bank responds. It can be accepted or declined. An authorisation code is transmitted back through the Association.

- Step #6: This authorisation code is sent to the Acquiring bank.

- Step #7: The approval code goes back through to the terminal, showing the customer and merchant that the payment has been processed successfully.

- Steps #8 & 9: The consumer side of the settlement of funds is where the Issuing bank effectively bills the customer, and they pay the bank, which usually presents itself as a transaction on a bank statement.

Settlement takes places at the end of each working day when a merchant reviews sales, credits and void payments. Once complete, payment terminals and gateways transmit this information to the merchant account for deposit. Acquiring banks do the same, sending transaction information for settlement through to the relevant card-issuing bank.

Within 48 to 72 hours merchants will receive their funds, minus a discount fee, dependent on range of factors, such as the type of business, amount of risk (e.g. cardholder not present, percentage of chargebacks and fraud on average in the sector, online or phone transactions) and other costs involved in the release of funds. Card associations decide the amount of risks involved with credit card transactions, which impacts the ‘discount’ applied before funds are released.

Merchants can encounter further costs even after funds are released, which is why this money is technically classed as a loan for accounting purposes, until the end of the financial year. A transaction could be downgraded, when it fails to meet interchange requirements (e.g. not capturing the correct card information, or settling after a deadline has lapsed). Payments could also be reversed or result in a dispute or fraud.

Merchants ultimately carry the burden of these costs, but merchant and Acquiring services also share short-term and cash flow risks, making security a priority for every institution involved in the transaction.

Secure Trading are an independent payment services provider, not tied to any specific Acquiring bank. However we do have excellent relationships with leading acquirers around the world and therefore can help you find the right acquiring partner for your business. Find out more here